https://twitter.com/moxlosllc/status/1679625503316099074?s=46&t=Y4fVsDnz2q8uZ3VNKeco4A

July 13, 2023

June 13, 2023

Bidenflation Continues

Prices continue to increase more under Biden than it did under either of his predecessors.

https://twitter.com/moxlosllc/status/1668746581032554497?s=46&t=Y4fVsDnz2q8uZ3VNKeco4A

Biden's Wage Cuts

While real earnings increased more under Trump than Obama, real wages under Biden continue to stagnate.

May 10, 2023

Bidenflation Continues

April 27, 2023

Biden’s IRA a BUST

March 26, 2023

Biden’s Fib Gets Bigger

January 2, 2023

Looming Fiscal Disaster

While the conclusion is that a combination of dramatic tax increases and/or dramatic spending cuts are absolutely going to happen, there is a third factor that is also almost certain: Inflation which reduces the relative value of the debt and means higher interest rates.

An analysis from economists at the University of Pennsylvania's Wharton School found that American fiscal policy is in "permanent imbalance as current debt plus projected future spending outstrips future tax revenue," demanding a substantial decrease in expenditures or a substantial rise in revenues.

The economists forecasted that the fiscal imbalance would equal 7% of the present value of all future gross domestic product over the next 75 years. Restoring order to the federal budget would require across-the-board cuts to programs such as Social Security, Medicare, and Medicaid, across-the-board increases to payroll taxes, individual taxes, and business taxes, or some combination of tax hikes and spending cuts.

December 13, 2022

Consumer Price Increases Still High

CPI, Consumer Price Index, released today, shows that while the rate of price increases has slowed down, we are still seeing significantly higher price increases than were seen in the previous two administrations.

December 9, 2022

Producer Price Increases still a problem

PPIFIS - Producer Price Index by Commodity: Final Demand was released today by FRED (Federal Reserve Bank of St. Louis).

An increase of 0.3% from previous month.

Inflation is still a problem.deral Reserve Bank of St. Louis

Ineffectual

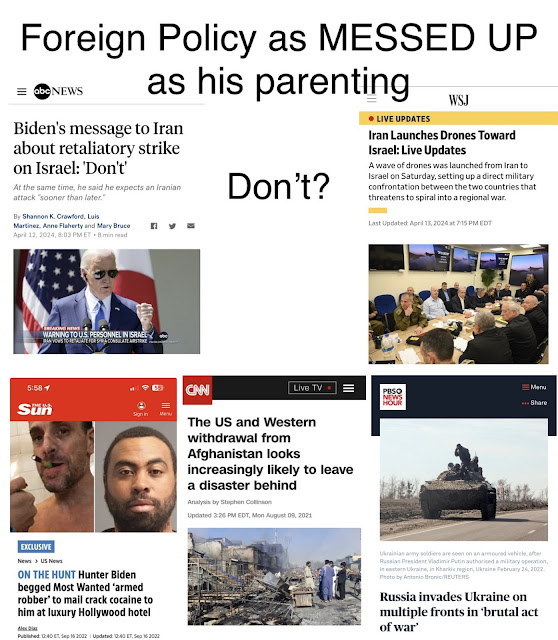

US President Joe Biden told Prime Minister Benjamin Netanyahu that the US will not aid any Israeli counterattack on Iran , US media report,...

-

The most recent data on national health care expenditures shows that in 2021 the Government controls ~64% of spending including the subsidy ...

-

US President Joe Biden told Prime Minister Benjamin Netanyahu that the US will not aid any Israeli counterattack on Iran , US media report,...

-

An embarrassment to our country. https://x.com/moxlosllc/status/1701240375812182340?s=12